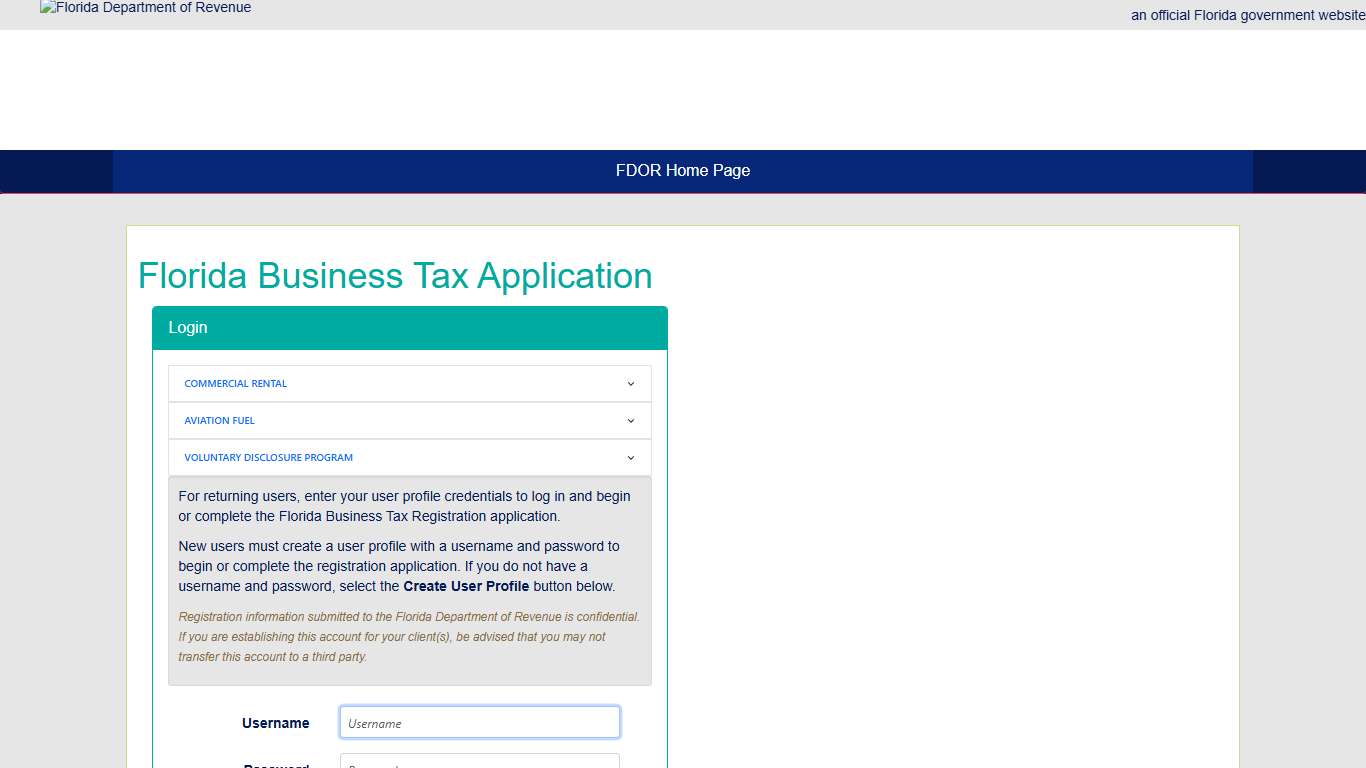

Florida Department Of Revenue Login

Login - Online Taxpayer Application

For returning users, enter your user profile credentials to log in and begin or complete the Florida Business Tax Registration application. New users must create a user profile with a username and password to begin or complete the registration application. If you do not have a username and password, select the Create User Profile button below.

https://taxapps.floridarevenue.com/taxregistration

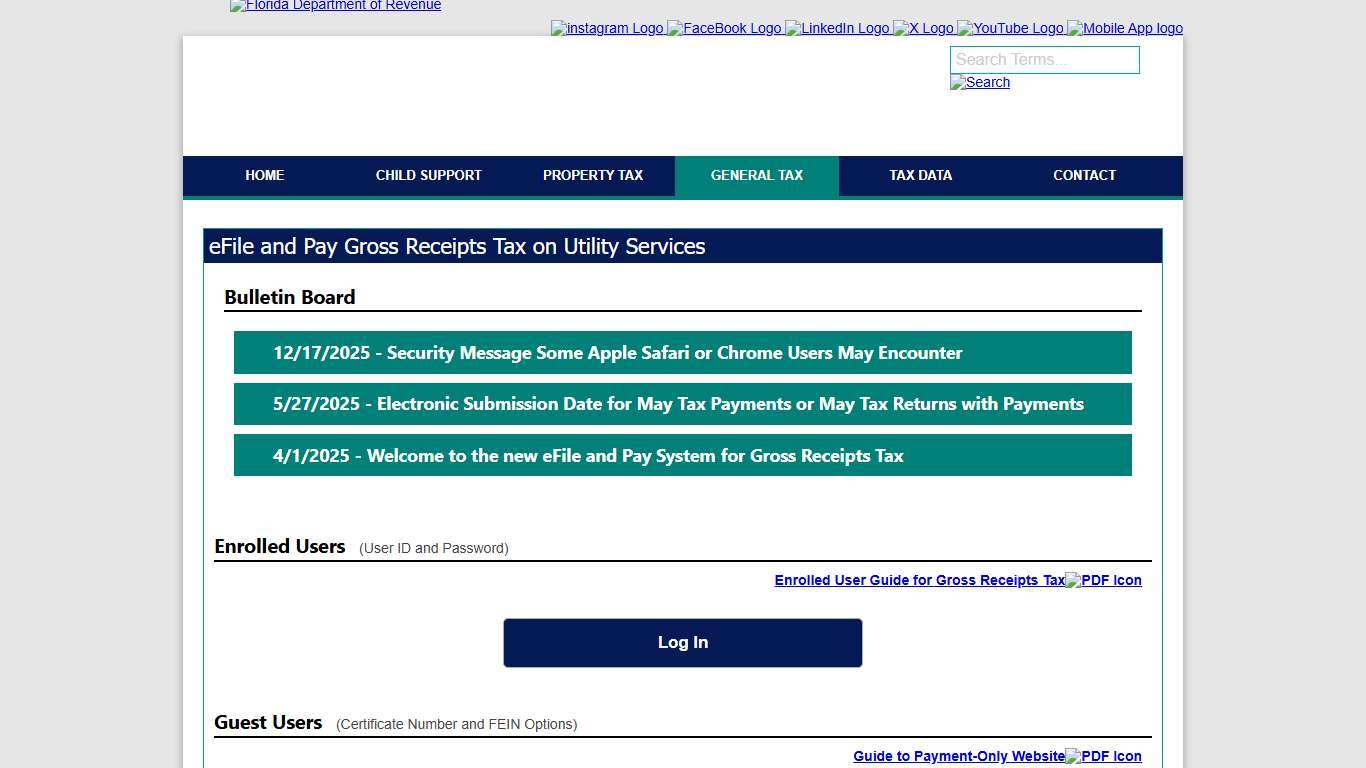

eFile and Pay Gross Receipts Tax

eFile and Pay Gross Receipts Tax on Utility Services Enrolled Users (User ID and Password) Guest Users (Certificate Number and FEIN Options) Document Lookup (Requires FEIN, Certificate Number, and Confirmation Number)...

https://floridarevenue.com/taxes/eservices/Pages/grtlogin.aspx

File and Pay Corporate Income Tax

Enter Your Login Information. User ID: *. Password: *. OR. FEIN: *. Business ... Florida Department of Revenue. By turning off Javascript, you are ...

https://taxapps.floridarevenue.com/Corporate/Login.aspxe-Services Enrollment

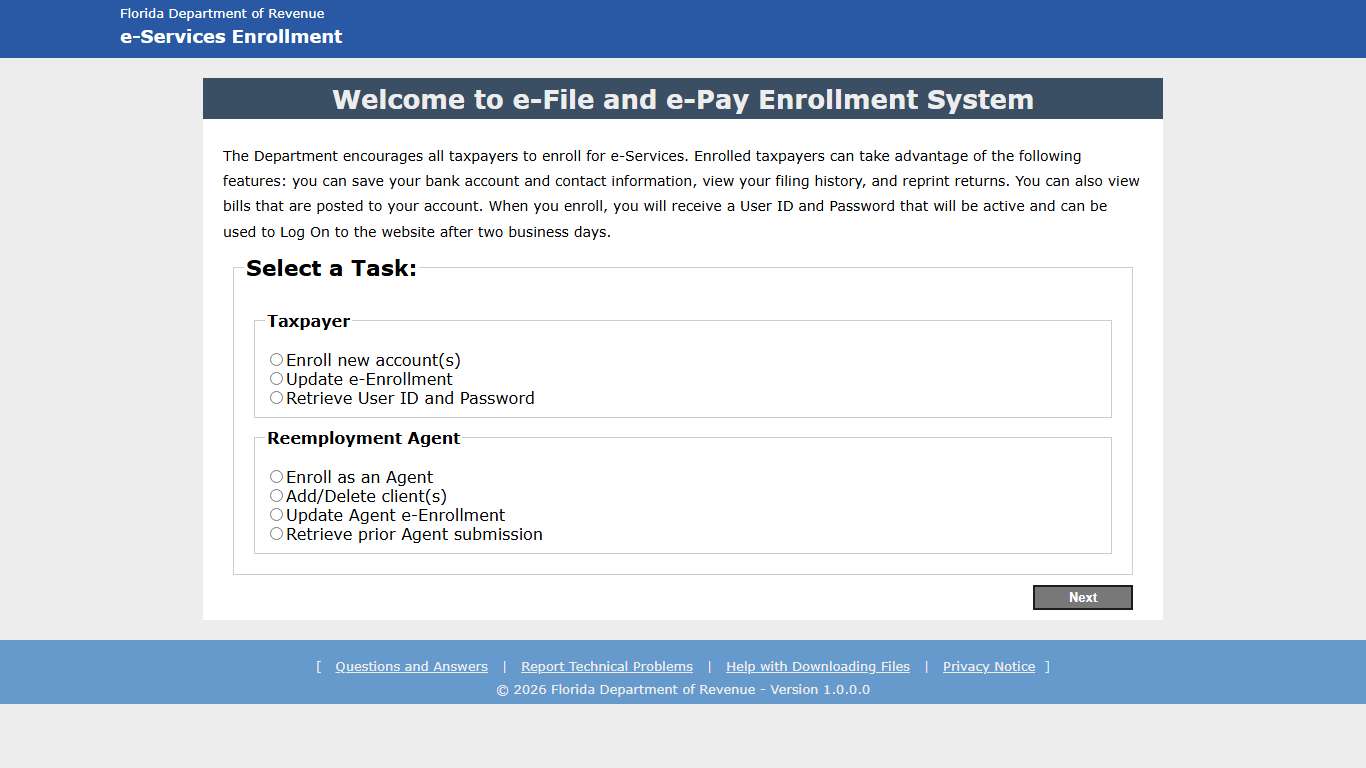

The Department encourages all taxpayers to enroll for e-Services. Enrolled taxpayers can take advantage of the following features: you can save your bank account and contact information, view your filing history, and reprint returns. You can also view bills that are posted to your account.

https://taxapps.floridarevenue.com/eenrollment/

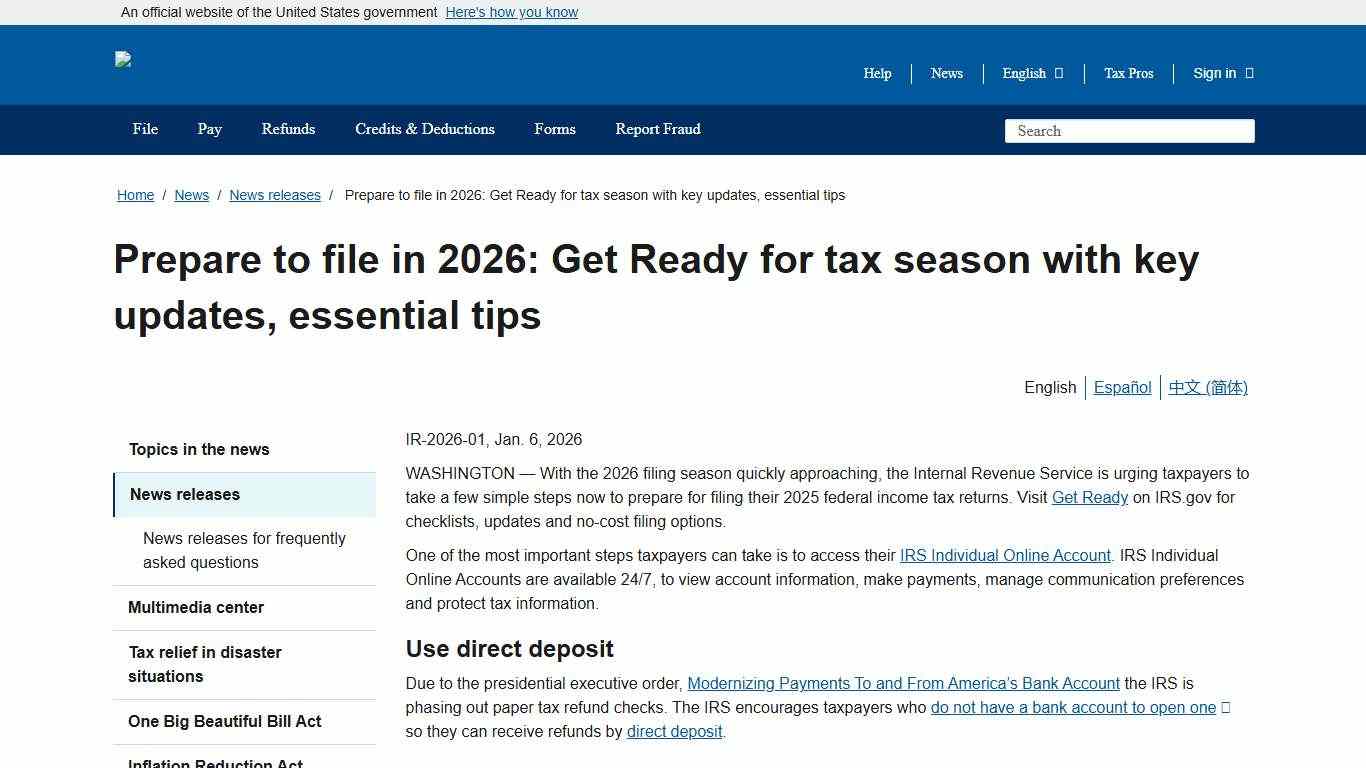

Prepare to file in 2026: Get Ready for tax season with key updates, essential tips Internal Revenue Service

IR-2026-01, Jan. 6, 2026 WASHINGTON — With the 2026 filing season quickly approaching, the Internal Revenue Service is urging taxpayers to take a few simple steps now to prepare for filing their 2025 federal income tax returns. Visit Get Ready on IRS.gov for checklists, updates and no-cost filing options.

https://www.irs.gov/newsroom/prepare-to-file-in-2026-get-ready-for-tax-season-with-key-updates-essential-tips

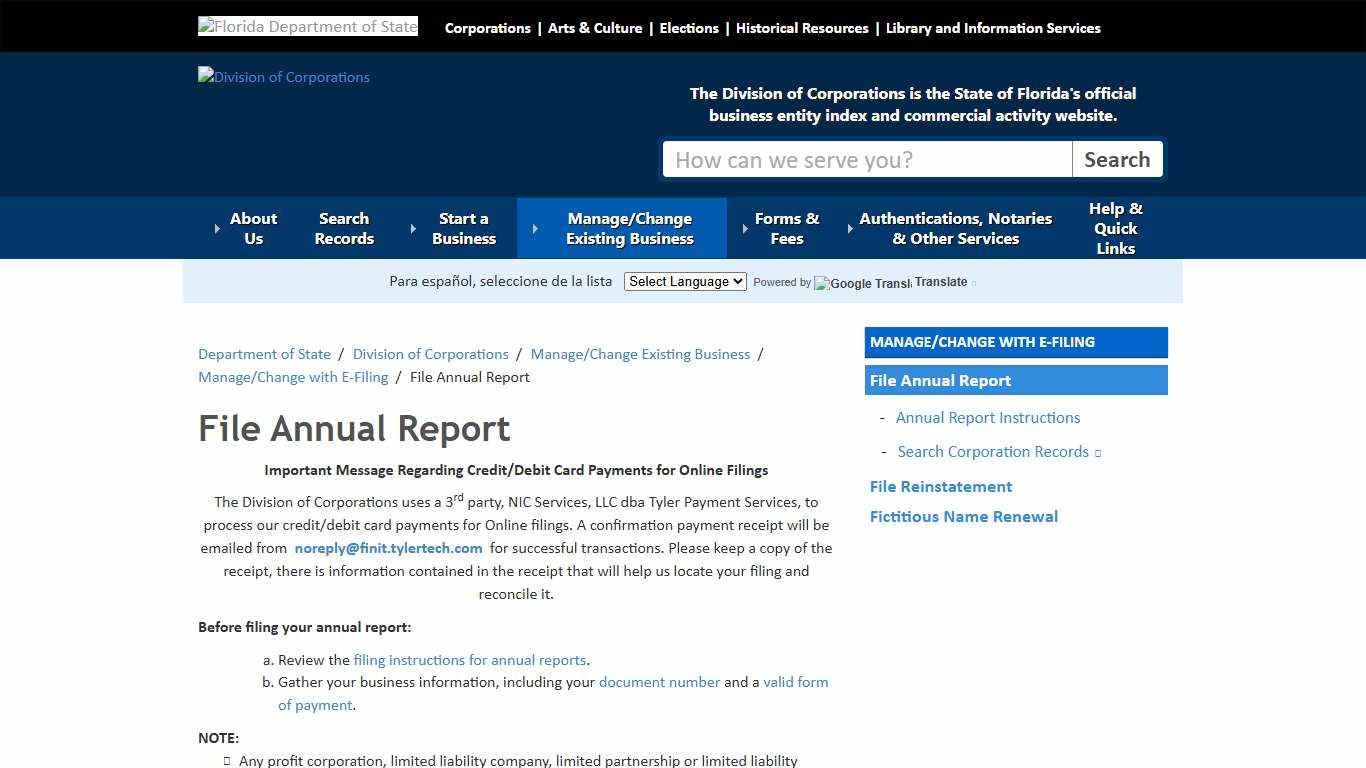

File Annual Report - Division of Corporations - Florida Department of State

File Annual Report Important Message Regarding Credit/Debit Card Payments for Online Filings The Division of Corporations uses a 3rd party, NIC Services, LLC dba Tyler Payment Services, to process our credit/debit card payments for Online filings. A confirmation payment receipt will be emailed from [email protected] for successful transactions.

https://dos.fl.gov/sunbiz/manage-business/efile/annual-report/

Florida employer tax information Square Support Center - US

Florida employer tax information Who is this article for? Square Payroll subscribers About Florida employer tax information With Square, you can run payroll, pay your taxes and stay ahead of the compliance to focus on running your business. This guide is intended for your state taxes only.

https://squareup.com/help/us/en/article/5655-florida-employer-tax-information

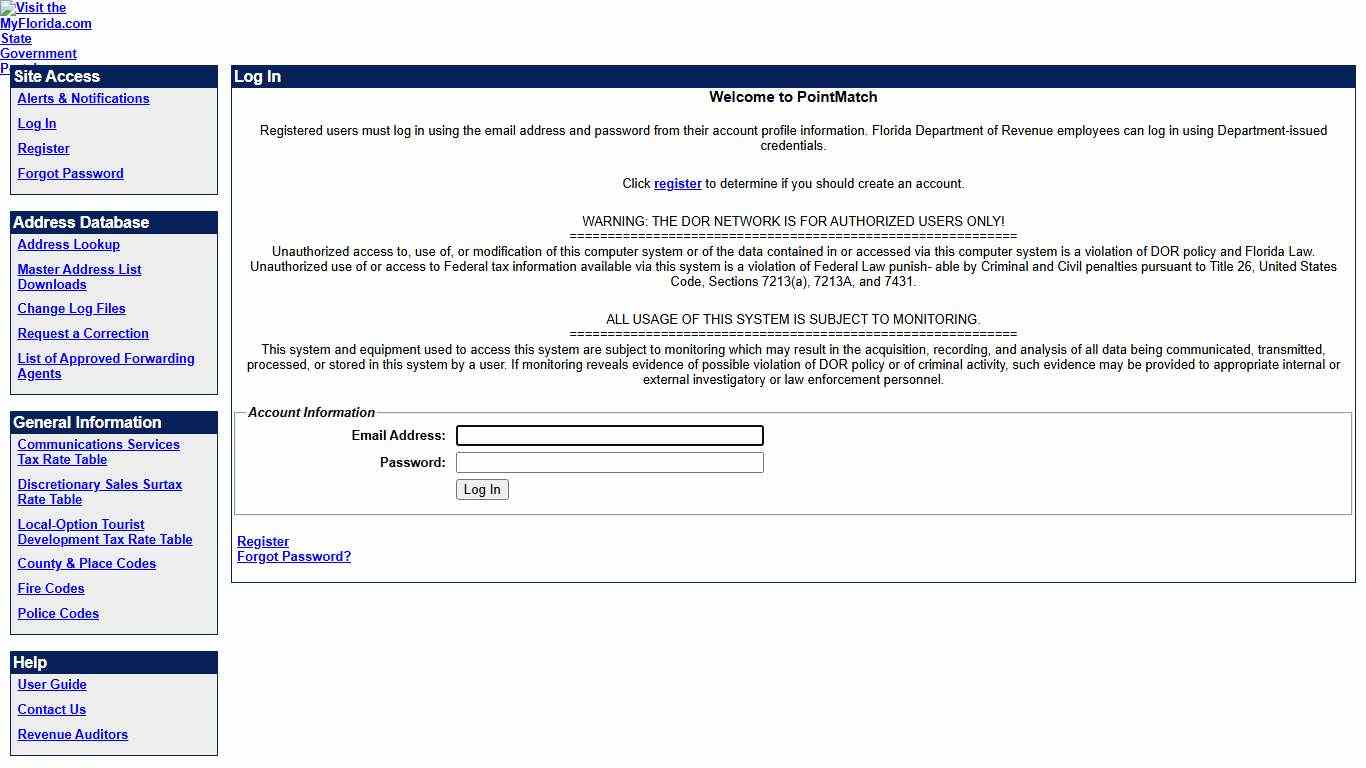

Log In

Welcome to PointMatch Registered users must log in using the email address and password from their account profile information. Florida Department of Revenue employees can log in using Department-issued credentials. Click register to determine if you should create an account. WARNING: THE DOR NETWORK IS FOR AUTHORIZED USERS ONLY!

https://pointmatch.floridarevenue.com/LocalGovernment/ProjectCase/Default.aspx

File Annual Report - Division of Corporations - Florida Department of State

File Annual Report Important Message Regarding Credit/Debit Card Payments for Online Filings The Division of Corporations uses a 3rd party, NIC Services, LLC dba Tyler Payment Services, to process our credit/debit card payments for Online filings. A confirmation payment receipt will be emailed from [email protected] for successful transactions.

https://dos.fl.gov/sunbiz/manage-business/efile/annual-report/

FAQ

The new eFile and Pay system is a free, secure website that allows Florida taxpayers to file returns and make payments online. Through the system, businesses can complete several tax functions quickly and securely. The new eFile and Pay system is hosted by a new vendor, so taxpayers who bookmarked the previous URL(s) will need to change their bookmark(s).

https://floridarevenue.com/taxes/filepayinfo/Pages/faq.aspx

Florida eFile & Pay System 2026 Keith L. Jones, CPA

The Florida Department of Revenue is overhauling its online tax filing system. If you file sales and use tax, solid waste fees, gross receipts tax, or any of a dozen other state taxes electronically, this affects you directly. The transition isn't optional.

https://keithjones.cpa/blog/florida-efile-pay-system-2026

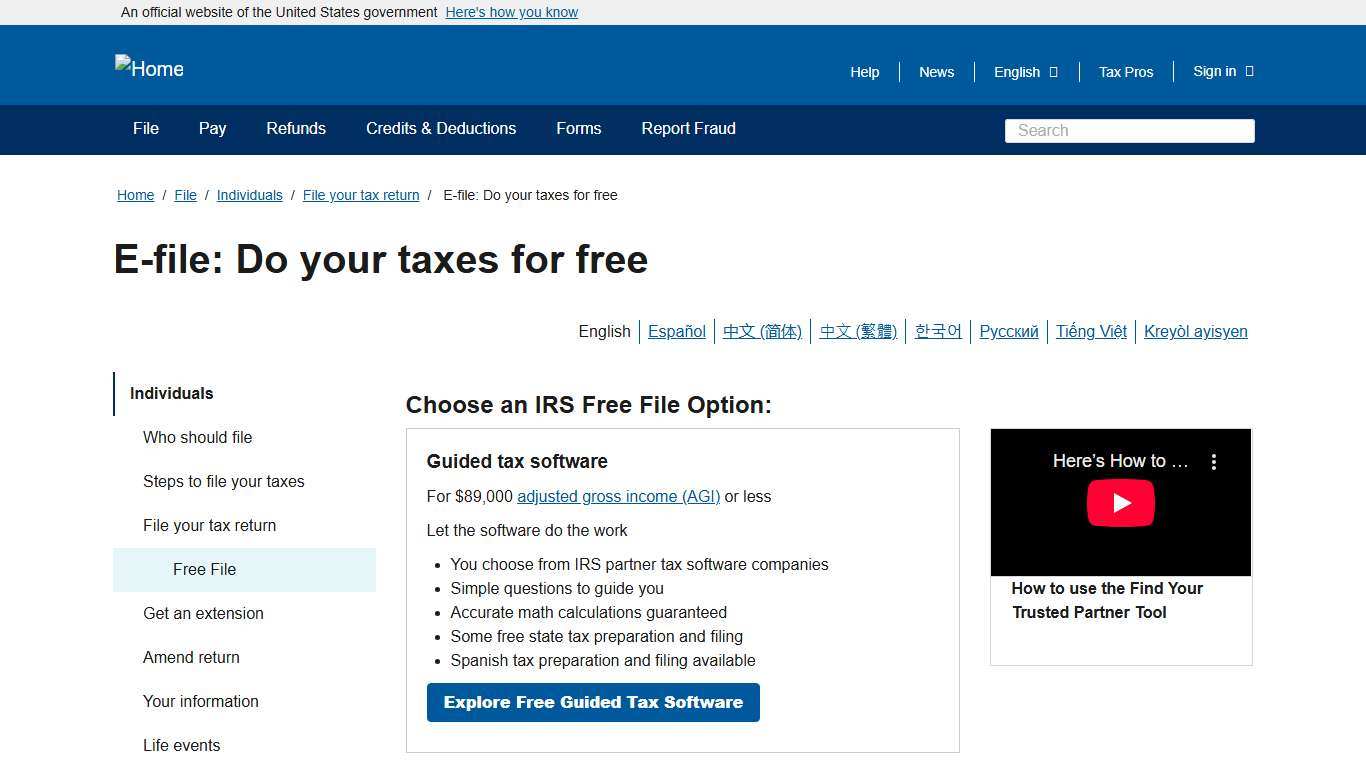

E-file: Do your taxes for free Internal Revenue Service

Choose an IRS Free File Option: Guided tax software For $89,000 adjusted gross income (AGI) or less Let the software do the work - You choose from IRS partner tax software companies - Simple questions to guide you - Accurate math calculations guaranteed - Some free state tax preparation and filing - Spanish tax preparation and filing available How to use the Find Your Trusted Partner Tool Frequently Asked Questions...

https://www.irs.gov/e-file-do-your-taxes-for-free